W4 calculator 2020

Use your estimate to change your tax withholding amount on Form W-4. Email marketing is the act of sending a commercial message typically to a group of people using emailIn its broadest sense every email sent to a potential or current customer could be considered email marketingIt involves using email to send advertisements request business or solicit sales or donationsEmail marketing strategies commonly seek to achieve one or more.

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

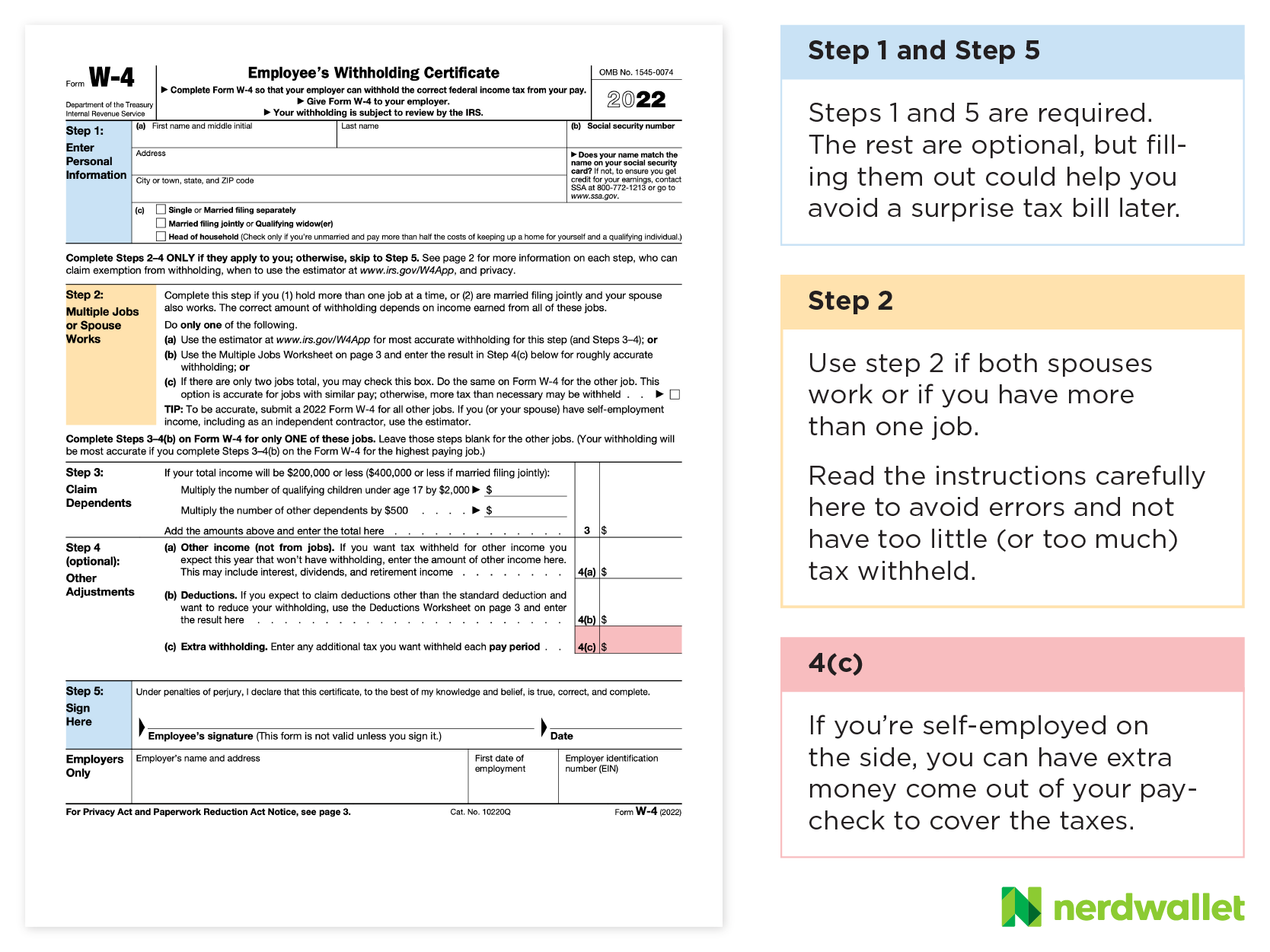

The IRSs W-4 estimator or NerdWallets tax calculator can also help.

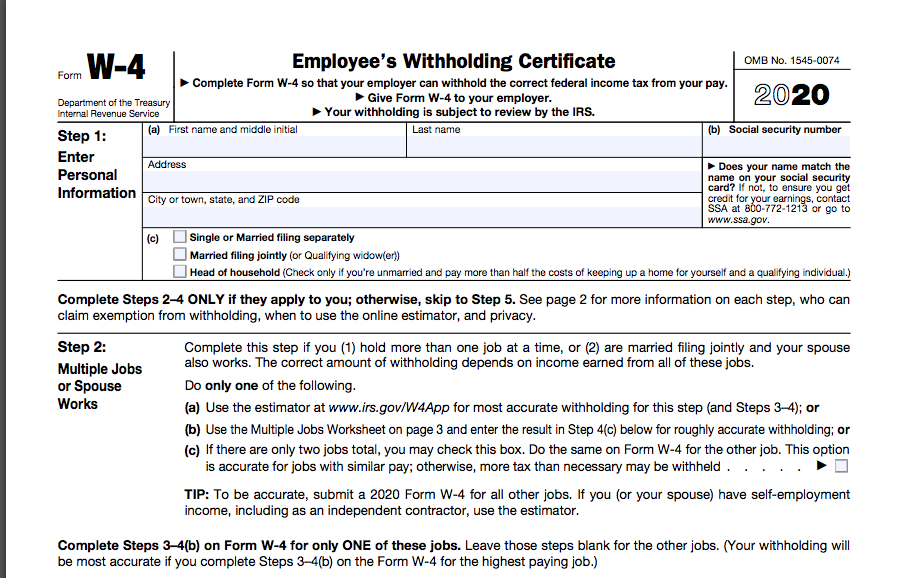

. Form W-4P Withholding Certificate for Pension or Annuity Payments. If you want to adjust the size of your paycheck first look to. My question is how am i transferring the information from Step 3 on the 2020 W4 form to quickbooks.

Gross Pay Method. The EITC can be as much as 6660 for a family with qualifying children. As the leader in tax preparation.

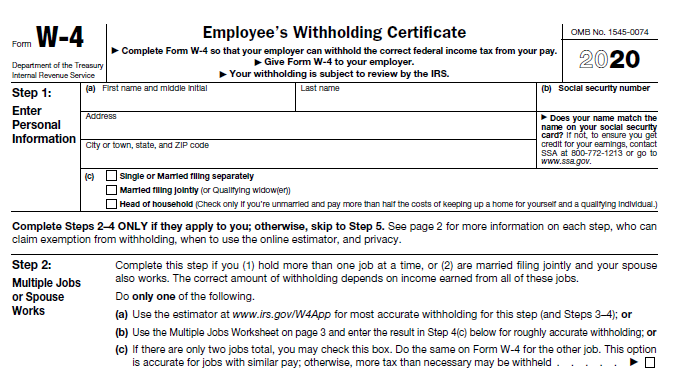

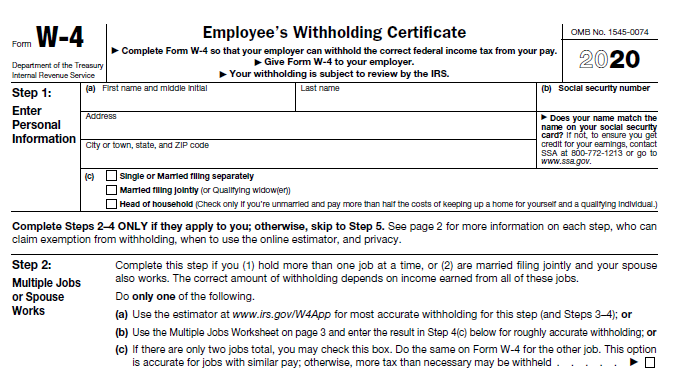

Since early 2020 any change made to state withholding must be made on Form OR-W-4 as the new federal Form W-4 cant be used for Oregon withholding purposes. After You Use the Estimator. Our free W4 calculator allows you to enter your tax information and adjust your paycheck withholding to increase your refund or take-home pay on each paycheck by show you how to fill out your 2020 W 4 Form.

Switch to Maryland salary calculator. Switch to Nebraska hourly calculator. If you dont use the online calculator use this worksheet to estimate the number of allowances to claim on your highest paying job.

Federal Filing Status of Federal Allowances. Based on aggregated sales data for all tax year 2020 TurboTax products. Web analytics is the measurement collection analysis and reporting of web data to understand and optimize web usage.

In the past it was simple employee filled out withhold 1 dependent you wrote 1 dependent in quickbooks. Federal Filing Status of Federal Allowances. Generally if your 2019 or 2020 income W-2 income wages andor net earnings from self-employment etc was less than 56844 you might qualify for the Earned Income Tax Credit.

Gross Pay YTD. Previously filed Oregon or federal withholding statements Form OR-W-4 or Form W-4 which are used for Oregon withholding can remain in place if the taxpayer doesnt change their. Gross Pay Method.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. The W-4 form has changed. Form W-4 Employee Withholding Certificate.

Financial advisors can also help with investing and financial plans including retirement homeownership insurance and more to make sure you are preparing for the future. Must contain at least 4 different symbols. 2021 2022 Paycheck and W-4 Check Calculator.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. If you did not receive this payment you can claim the money via the Recovery Rebate Credit on your 2020 Tax Return which was due on October 15 2021. The design of the Form W-4 does not give you the actual tax withholding amount therefore we have created this paycheck and integrated W-4 calculator tool for you.

How You Can Affect Your Minnesota Paycheck. 2020 Form OR-W-4 Oregon Withholding Office use only Page 1 of 4 150-101-402 Rev. A financial advisor in Minnesota can help you understand how taxes fit into your overall financial goals.

ASCII characters only characters found on a standard US keyboard. Or keep the same amount. IRS tax forms.

Remember on your 2020 Return you can use the 2019 or 2020 income to determine your EITC. What to keep in mind when filling out Form W-4. This Minnesota hourly paycheck calculator is perfect for those who are paid on an hourly basis.

6 to 30 characters long. 2020 Form W-4 Questions and Answers. Not how to use the tax calculator or go to the IRSgov website for updates about the 2020 W4.

Switch to Oklahoma hourly calculator. TaxAct 2020 Tax-Exempt Organizations Edition. Switch to Texas hourly calculator.

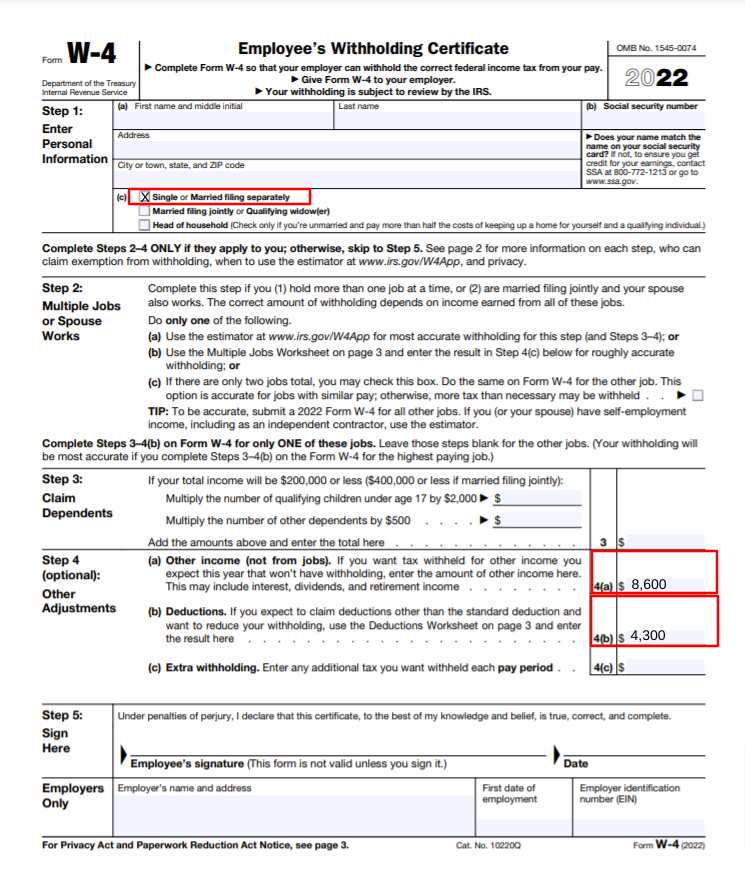

Web analytics applications can also help companies measure the results of traditional print or. Form W-4 2022 Page 3 Step 2bMultiple Jobs Worksheet Keep for your records If you choose the option in Step 2b on Form W-4 complete this worksheet which calculates the total extra tax for all jobs on. Americas 1 tax preparation provider.

Maximize your refund with TaxActs Refund Booster. Switch to Minnesota salary calculator. Notice 1392 Supplement Form W-4 Instructions for Nonresident Aliens PDF.

Federal Filing Status of Federal Allowances. Calculate your Oklahoma net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Oklahoma paycheck calculator. 01 Employers name.

The tax calculator below allows you to estimate your share of the first Coronavirus Crisis related stimulus payments issued to most American taxpayers or residents. Adjust your W-4 withholdings to get a bigger tax refund or a bigger paycheck. 1 best-selling tax software.

Switch to Montana hourly calculator. This Maryland hourly paycheck calculator is perfect for those who are paid on an hourly basis. TaxAct 2020 Professional 990 Edition.

TaxAct 2020 Professional 990 Enterprise Edition. Now you can easily create a Form W-4 that reflects your planned tax withholding amount. The new W-4 introduced in 2020 still asks.

Web analytics is not just a process for measuring web traffic but can be used as a tool for business and market research and assess and improve website effectiveness. If the result from the W-4 calculator is different from your current withholding ask your employer for a fresh W-4 form to fill out.

How To Calculate Federal Income Tax

Irs Releases New Form W 4 And Online Withholding Calculator Personal Wealth Strategies

W 4 Form Basics Changes How To Fill One Out

W 4 Form What It Is How To Fill It Out Nerdwallet W4 Tax Form Tax Forms Changing Jobs

A New Form W 4 For 2020 Alloy Silverstein

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Mobile Farmware Irs Form W 4 2020

Online Tax Withholding Calculator 2021

Irs Improves Online Tax Withholding Calculator

Free W 4 Calculator Tax Withholding Info For Hr Professionals Goco Io

The New Form W 4 Form Is Different Really Different Asap Accounting Payroll

2022 New Federal W 4 Form No Allowances Plus Computational Bridge

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Tax Withholding Calculator 2022 Federal Income Tax Zrivo

W 4 Form What It Is How To Fill It Out Nerdwallet

Test Your Knowledge Of The Irs Tax Withholding Estimator Bds Financial Network

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager